Bank Account

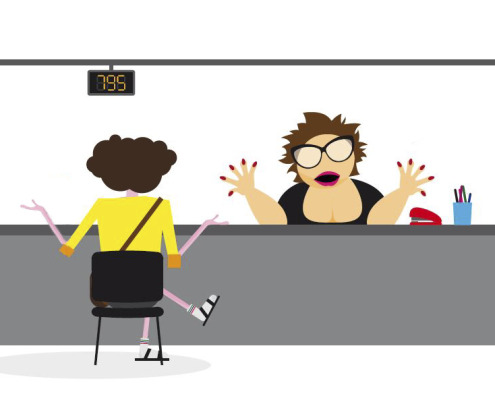

In Barcelona there is a great variety of banks and each bank usually offers more than one option for opening a bank account. That is why it can get confusing choosing which bank would be the best solution.

Here are some tips what to watch for when choosing the bank account in Barcelona:

1. Residential/non- residential account – In Spain there are two basic types of accounts:

– non-residential – can be opened only with your passport/national ID with no need of Spanish address (not offered by every bank)

– residential – requires NIE Card as a proof or residency

2. No commission – There are banks that does not charge any commission if you send your salary to your account (cuenta nómina) or if you keep certain balance (cuenta sin nómina).

3. Get a TV or tablet – some banks offer presents for opening your bank account and sending your salary there, but be ready to pay commissions for this account

4. Permanency period – with some bank accounts you sign one year permanency period (especially used when given gifts for opening the bank account)

5. Free debit and credit card – check there is no yearly commission for the credit /debit cards

6. Cash withdrawal – be well informed in which cash machines is the money withdrawal for free and if there is any net of “partner” banks that you can withdraw the money without or less commission.

7. Free money transfers – don’t forget to ask if there is any commission for national/international transfers

8. In English – some banks offer online banking as well as printed documents (contract, bank statements, leaflets, …) in English

9. Opening hours – most of the banks have the opening hours Mo-Fr 9:00-14:00, and usually opening on Thursday afternoon. There are banks with more flexible hours, but it is not that usual. Be aware that in the summer the banks have shorter opening hours and some are closed the whole august!

Are you lost in all the choices? Let NIE Barcelona help you choose the best bank account that corresponds your needs.